Plug-inhybrides (PHEV's)

Plug-inhybrides (ook wel PHEV’s genoemd) zijn de voorbije jaren uitgegroeid tot een erg populaire keuze als bedrijfsauto. Dat hoeft niet te verwonderen. Je kunt er een groot deel van je dagelijkse trajecten elektrisch mee rijden en hoeft dankzij de verbrandingsmotor niet te panikeren wanneer je een langere reis moet maken of geen laadpunt vindt. In die optiek zijn ze voor vele bestuurders een ideale opstap naar volledig elektrisch rijden. Een bijkomend voordeel van een hybride auto is dat hij beschikbaar is in heel wat vormen en maten, van middenklassers over gezinsbreaks tot grote SUV’s.

Wijzigingen fiscale aftrekbaarheid

Tot nog toe konden plug-inhybride voertuigen genieten van aardig wat fiscale voordelen. Je betaalt er nog steeds minder BIV en verkeersbelasting op en geniet van een maximale fiscale aftrekbaarheid, terwijl de CO2-bijdrage en het Voordeel van Alle Aard een stuk lager liggen dan bij modellen met benzine- of dieselmotor.

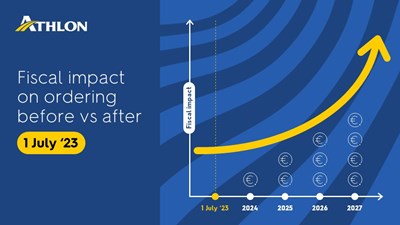

1 juli 2023

Er is echter verandering op til. Sinds 1 januari 2023 is de aftrekbaarheid van het gedeelte fossiele brandstofkosten voor plug-inhybrides al beperkt tot 50%. Vanaf 1 juli 2023 worden de kaarten opnieuw geschud. PHEV’s en alle andere niet-emissievrije voertuigen, besteld na die datum, zien hun fiscale aftrekbaarheid niet langer vastgeklikt voor de duurtijd van het leasecontract, maar zullen deze stelselmatig zien dalen van de huidige aftrek naar een maximum van 75% in 2025, 50% in 2026, 25% in 2027 en uiteindelijk 0% vanaf 2028.

CO2-bijdrage (bedrijfswagens)

Tegelijk stijgt de CO2-bijdrage voor PHEV's en alle andere niet-emissievrije voertuigen. Deze maandelijkse RSZ-bijdrage wordt vermenigvuldigd met factor 2,25 in 2023 en 2024, factor 2,75 in 2025, factor 4 in 2026 en factor 5,5 vanaf 2027.

Dat blijft vanzelfsprekend niet zonder gevolgen voor de total cost of ownership (TCO).

Zijn plug-inhybrides nog fiscaal interessant?

Hoewel ze voor vele bestuurders een interessante transitieoplossing vormen, zullen plug-inhybrides dus stelselmatig duurder worden de komende jaren. Hetzelfde geldt voor diesel- en benzinevoertuigen.

Twee voorbeelden.

• Wie vóór 1 juli 2023 een Mercedes-Benz A250e plug-inhybride bestelt als leasewagen, geniet gedurende de hele looptijd van een fiscale aftrekbaarheid van 100% voor alle kosten, met uitzondering van de brandstof (50%). Als we voor dit voertuig, gebaseerd op een maandelijkse huurprijs van € 800, alle variabele en fiscale lasten in rekening brengen, komen we uit op een fiscale Total Cost of Ownership (TCO) van € 1.053. Bestel je dezelfde wagen ná 1 juli 2023, dan stijgt de gemiddelde maandelijkse TCO-prijs over de looptijd van het contract naar € 1.236, oftewel een stijging van 17,43% of € 183 per maand.

• Als we dezelfde rekenoefening maken voor een Audi A3 Sportback diesel, gebaseerd op een maandelijkse huurprijs van € 543 waarbij we vervolgens alle variabele en fiscale lasten in rekening brengen, komen we uit op een fiscale Total Cost of Ownership (TCO) van € 857. Bestel je ditzelfde voertuig na 1 juli 2023, dan stijgt de gemiddelde TCO-prijs over de looptijd van het contract naar € 1.019 per maand. Een stijging van € 162/maand oftewel een toename van het totale kostenplaatje met 18,92%.

| Voertuig |

Brandstof |

TCO (berekend op 48maand & 20.000km/jaar) |

Average TCO |

Delta |

| |

|

Actual |

2024 |

2025 |

2026 |

2027 |

2028 |

|

(act. vs average) |

| Audi A3 Sportback 2.0 30 TDi Attraction 85kW/116pk |

Diesel |

€857,24 |

€925,42 |

€952,69 |

€1.039,86 |

€1.159,66 |

€1.197,65 |

€1.019,40 |

18,92% |

| Mercedes A-Klasse A 250 e Business Line |

PHEV (benzine) |

€1.053,09 |

€1.092,26 |

€1.167,76 |

€1.277,90 |

€1.408,49 |

€1.480,35 |

€1.236,60 |

17,43% |

(op mobiel: scroll naar rechts voor de volledige tabel)